Definition

Sickness benefit is a daily cash allowance paid for the number of days a member is unable to work due to sickness or injury.

Qualifying Conditions

A member is qualified to avail of this benefit if he/she:

- Is unable to work due to sickness or injury and is confined either in a hospital or at home for at least four (4) days.

- Has paid at least three (3) months of contributions within the 12-month period immediately preceding the semester of sickness or injury. In determining the SE/VM/OFWs entitlement to the benefit, the SSS shall only consider those contributions paid prior to the semester of contingency.

- Has notified the employer, if employed, or the SSS, if SE/VM/OFW/separated from employment regarding his/her sickness or injury.

- Has used up all current company sick leave with pay for the current year, if employed, except sea-based OFWs.

Benefit Details

Amount of Benefit

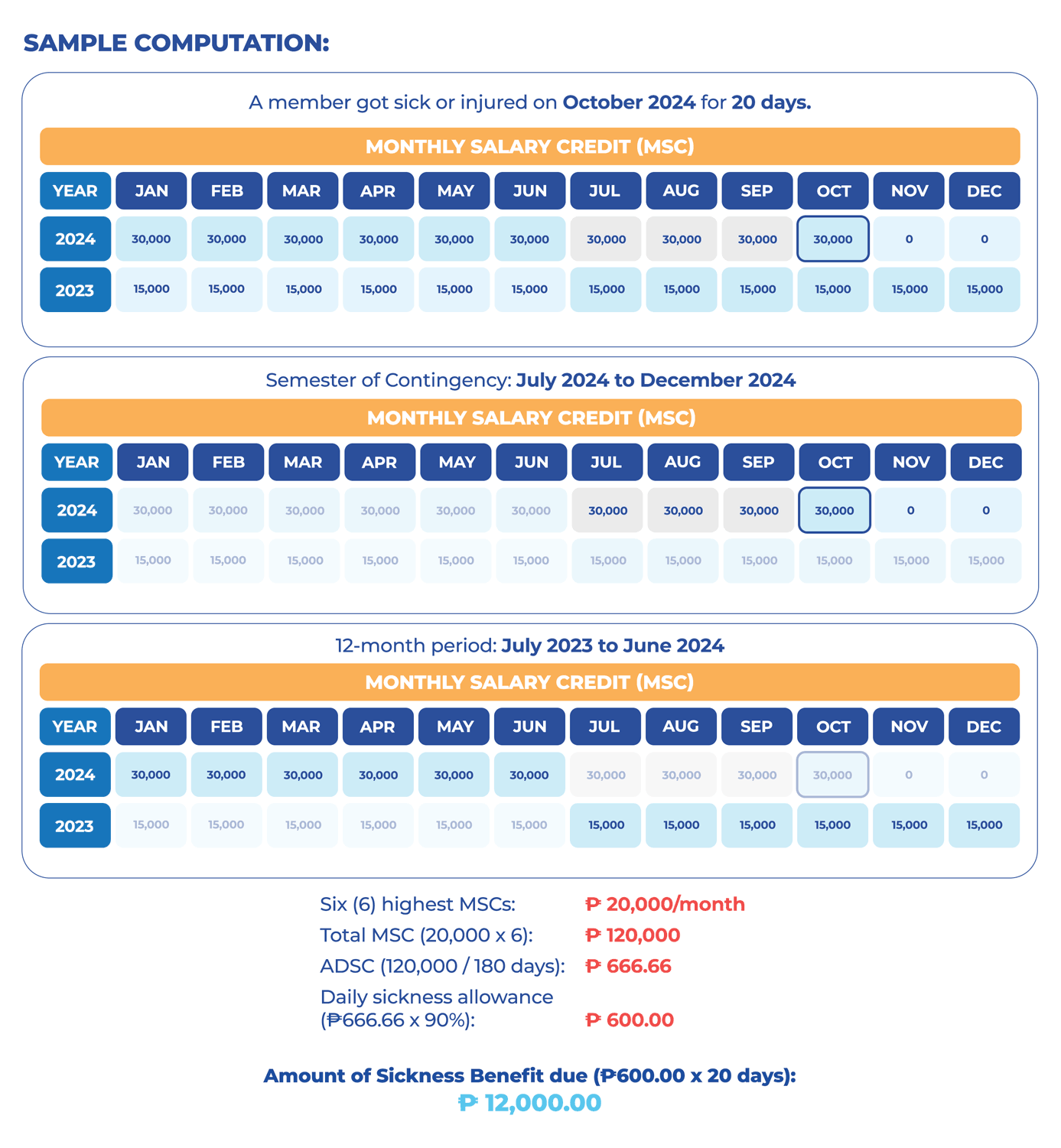

The amount of the member’s daily sickness benefit allowance is equivalent to ninety percent (90%) of his/her average daily salary credit (ADSC).

Benefit Computation

- Exclude the semester of contingency.

-

- A semester refers to two (2) consecutive quarters ending in the quarter of sickness.

- A quarter refers to three (3) consecutive months ending in March, June, September, or December.

- Count twelve (12) months backwards starting from the month immediately before the semester of contingency.

- Identify and add the (6) highest monthly salary credits within the 12-month period to arrive at the total monthly salary credit.

-

- Monthly salary credit (MSC) refers to the compensation base for contributions and benefits related to the total earnings for the month.

Refer to the SSS Contribution Table

| IMPORTANT: Pursuant to Circular No. 2020-032 dated 24 November 2020, starting January 2021, SS contribution includes Workers’ Investment and Savings Program or WISP (SSS Provident Fund) contribution. The computation of benefits under the Regular SSS Program shall be based on contributions up to ₱20,000 MSC.

Contributions paid within or after the semester of contingency shall not be considered in the computation of benefit. |

- Divide the total MSC by 180 days to get the average daily salary credit (ADSC).

- Multiply the ADSC by ninety percent (90%) to get the daily sickness allowance.

- Multiply the daily sickness allowance by the approved number of days to arrive at the amount of benefit due.

Contributions and benefits under the Regular SS and EC Programs shall be computed based on the member’s MSC up to the maximum of P20,000. The member’s contributions for MSC in excess of P20,000 shall be for the MPF Program and credited to the member’s individual account.

Limitations in Granting the Sickness Benefit

A member can be granted sickness benefit for a maximum of 120 days in one (1) calendar year. Any unused portion cannot be carried forward/added to the total number of allowable compensable days for the following year.

The sickness benefit shall not be paid for more than 240 days on account of the same illness. If the sickness or injury persists after 240 days, the claim will be considered a disability claim.

Prescriptive Period

Submission of Sickness Notification (for Employed)

- Home Confinement

- Employee to employer – Within five (5) calendar days after start of confinement

- Employer to SSS – Within five (5) calendar days after receipt from employee

- Hospital Confinement

- Employee to employer – Notification is not necessary

- Employer to SSS – Within one (1) year from date of hospital discharge

Submission of Sickness Benefit Application (for SE/VM/OFW)

- Home confinement

- Within five (5) calendar days after start of confinement

- If hospital confinement

- Within one (1) year from date of hospital discharge

Submission of Sickness Benefit Reimbursement Application (Employer)

- If home confinement

- Within one (1) year from start of confinement

- If hospital confinement

- Within one (1) year from date of hospital discharge

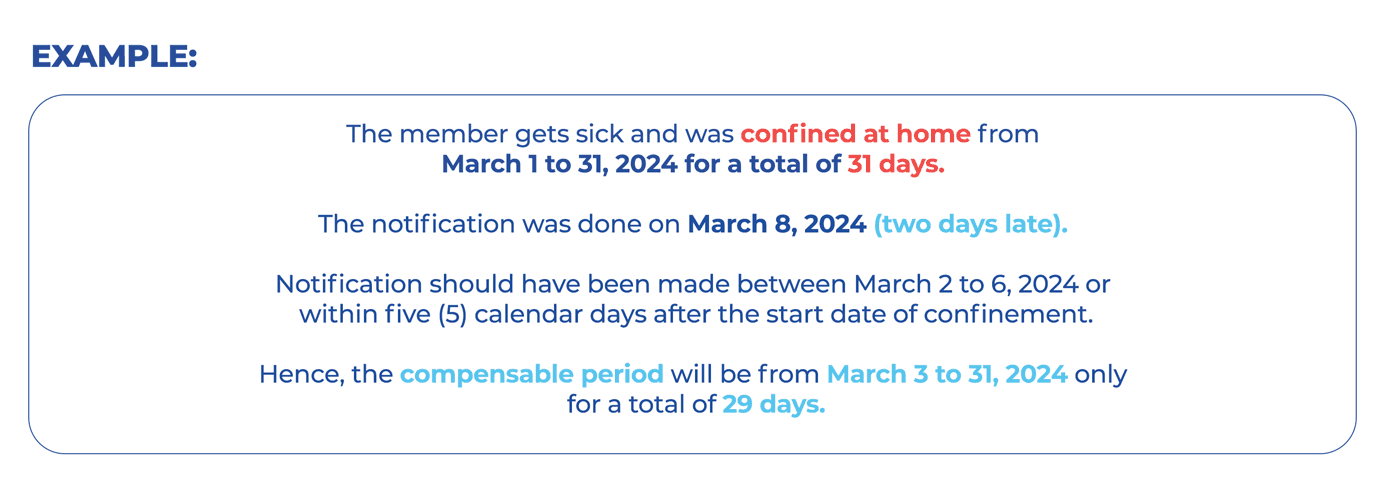

Implications of Late Filing

Failure to observe the rule on notification shall be a ground for the reduction or denial of the sickness claim application. If the member notifies the SSS beyond the prescribed five-day period, the confinement shall be deemed to have started not earlier than the fifth (5th) day immediately preceding the date of notification.

Benefit Disbursement

The sickness benefit claims shall be mandatorily disbursed through the qualified payee’s Unified Multi-Purpose Identification (UMID) card enrolled as Automated Teller Machine (ATM) card. In the absence of this, payment shall be made thru participating banks under the Development Bank of the Philippines (DBP) Disbursement Facility via the Philippine Electronic Fund Transfer System and Operations Network (PESONet), electronic wallets (E-Wallets), or accredited remittance transfer companies (RTCs)/cash payout outlets (CPOs).

Hence, qualified payees shall be required to enroll the following details in the Disbursement Account Enrollment Module (DAEM) and upload proof of account (POA), government-issued ID card/document in JPEG of PDF format, and selfie photo holding ID card/document and the uploaded POA of the disbursement account being enrolled in the My.SSS Facility in the SSS website:

| If through PESONet participating banks: | Bank name and account number |

| If through E-wallet: | Mobile number linked to bank account number |

| If through RTC/CPO: | Mobile number |

Members shall be notified by SSS through email or SMS upon crediting of their sickness benefit claims to their PESONet bank/E-wallet accounts, or if payment is already available through RTCs/CPOs. Members may also view the status of the disbursement through the Inquiry Module of the My.SSS account.

Crediting of benefit payments shall be made within five (5) banking days from date of settlement.

How to Apply

Submission of Sickness Notification (for Employed Members and Employers)

The member who got sick or injured shall immediately notify his/her employer of such fact and submit the following proof of illness or injury:

- Medical Certificate (Med 01688) indicating the following:

- Complete diagnosis

- Recommended number of days of sick leave including recuperation

- Clinic Address

- Contact Number

- License number written legibly

- Certified true copy of supporting medical documents

Upon receipt of the above documents, the employer shall in turn notify SSS online through its My.SSS account. Submission of documents over the counter is no longer necessary.

Submission of SBA (for SE/VM/OFW/NWS and Members Separated from Employment)

- Log in to your My.SSS account.

- Click “Submit Sickness Benefit Application” under the E-Services tab.

- Read the important reminders, then click “Proceed” to continue.

- Supply all required information, then click “Proceed”.

- Upload the required supporting document/s. You may click the “I” icon to view the list of documentary requirements and important reminders. Read and understand the Certification portion, then click “I Certify and Submit” to proceed. Then click “OK” to confirm the transaction.

- The System will display a notification message. Click “View” and then take note of your transaction details. Also check your inbox for email notification from SSS.

Submission of SBRA (for Employers)

- Log in to Employer’s My.SSS account.

- Click the “Submit SS Sickness Benefit Reimbursement Application (SBRA)” Tab.

- Enter the member’s CRN/SS Number or Claim Reference Number or Date Filed, then click the “Search” button.

- The details of the approved Sickness Notification will be displayed.

- Click the Claim Reference Number to proceed with the SBRA submission.

- Enter the required details as approved.

- The encoded information will display for employer’s review and certification.

- Email confirmation will be sent to the Employer of successful submission of SBRA.

Exemptions from Online Filing

The following sickness benefit claims, however, are exempted from the online filing, and must be submitted over the counter at any SSS branch office/Foreign Representative Office:

- Denied claim reconsidered from payment

- Unclaimed benefit of deceased member

- Unclaimed Reimbursement of Inactive/Closed/Terminated/Retired Employer

Documentary Requirements for Sickness Notification and Sickness Benefit Application

Basic Documents

- SSS Medical Certificate (Med 01688) indicating the following:

- Complete diagnosis

- Recommended number of days of sick leave including recuperation

- Clinic Address

- Contact Number

- License number written legibly

- Supporting medical documents for prolonged confinement/sickness, if any:

- Laboratory, X-ray, ECG, and other diagnostic results

- Operating room/clinical record that will support diagnosis

NOTE:

|

Additional Requirements for Self-Employed/Voluntary Member who were previously employed

If confinement period applied for is within the period of employment or prior to date of separation:

- Certificate of separation from employment with effective date of separation and no advance payment was granted (signed by the employer’s Human Resource Manager)

If confinement period applied for is after the date of separation:

- Certificate of separation from employment with effective date of separation (signed by the employer’s Human Resource Manager)

NOTE: Certificate of separation is not required for self-employed and voluntary members (previously employed) or those separated from employment under any of the following conditions in which other supporting document/s shall be required to be submitted as follows:

If company is on strike:

- Notice of strike duly acknowledged by the Department of Labor and Employment (DOLE); and

- Duly notarized Affidavit of Undertaking issued by the member stating that no advanced payment was granted

If company has been dissolved or has ceased operation:

- Duly notarized Affidavit of Undertaking issued by the member stating that no advanced payment was granted and with indicated effective date of separation

If there is a case pending before a court regarding separation of member:

- Certification from DOLE; and

- Duly notarized Affidavit of Undertaking issued by the member stating that no advanced payment was granted and with indicated effective date of separation

If separated from employment due to absence without leave (AWOL) or with strained relations with the employer:

- Duly notarized Affidavit of Undertaking issued by the member stating that no advanced payment was granted and with indicated effective date of separation